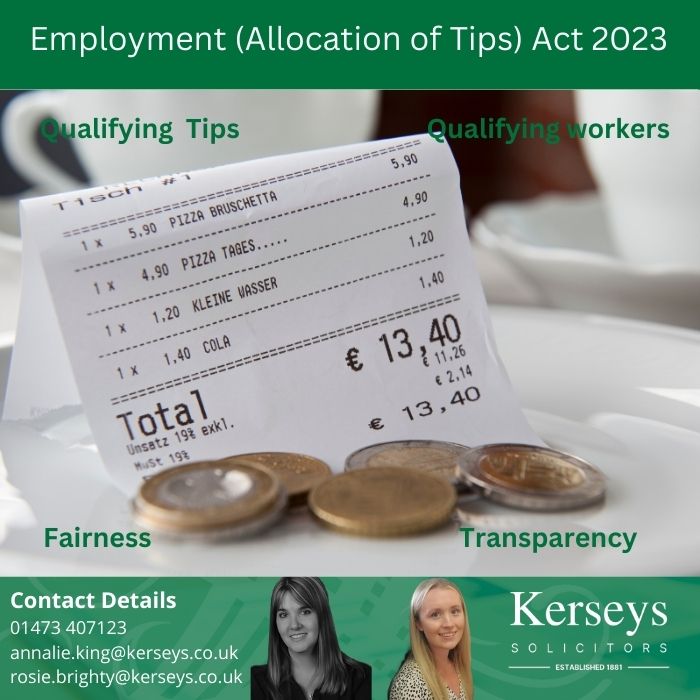

Employment (Allocation of Tips) Act 2023

Employment (Allocation of Tips) Act 2023 – Key points to note in preparation for change

It was recently reported that a waitress in America was dismissed after splitting a $10,000 tip with her colleagues. Although the cafe has asserted that the decision to dismiss the waitress was “nothing to do with the tip”, it has received widespread criticism for doing the same. Our employment law specialists consider in this blog how employers in England and Wales should approach the allocation of tips to ensure workers are treated fairly and that your business does not suffer any reputational damage in light of the awaited new legal framework.

Employment (Allocation of Tips) Act 2023 (the Act)

The Employment (Allocation of Tips) Act 2023 received Royal Assent in May 2023 and was introduced to ensure that tips, gratuities and service charges paid by customers are allocated to workers in a fair and transparent way. Substantive provisions of the Act are expected to be in force in July 2024.

Key points to note from the Act include:

- Businesses must allocate qualifying tips between workers of the employer at that place of business by the end of the month following which the tip was paid;

- Where qualifying tips, gratuities and service charges are paid at, or are otherwise attributable to, a place of business of an employer on more than an occasional and exceptional basis, the employer must have a written policy on dealing with qualifying tips, gratuities and service charges for the place of business. Businesses must create a record of how these have been dealt with for a period of three years beginning with the date that it was paid; and

- Workers will be able to enforce the obligations set out in the act by bringing a claim in the Employment Tribunals. This includes the right to bring a claim up to 12 months after the alleged failure to comply took place.

Draft statutory Code of Practice

The Department for Business and Trade consultation on the draft statutory Code of Practice (Code) which will support the Act closed on the 22 February 2024. The Government states that ‘all employers must have regard to the Code when designing and implementing their tipping policies and practices’, and that ‘judges have a duty to take this Code into account in determining disputes relating to tipping practices’. However, ‘the failure to fully observe the Code does not in itself amount to proof that an employer has been acting unfairly’.

The draft Code outlines four factors that employers need to consider and how they should approach them, namely: qualifying tips and qualifying workers, fairness, transparency and how to address problems.

It is anticipated that a summary of the final statutory Code of Practice will be published by the Government in Spring 2024. The Government have also stated that further non-statutory guidance will be published in due course to accompany the Code.

You can review the draft code here.

How Kerseys Solicitors can help

If you have any enquiries regarding the allocation of tips, please contact Annalie King, Partner and Head of our Employment Law team or Rosie Brighty, Trainee Employment Solicitor at Kerseys Solicitors. You can contact Annalie King or Rosie Brighty by telephone at Kerseys Solicitors in Colchester 01206 584584, Kerseys Solicitors in Ipswich 01473 213311 or Kerseys Solicitors in Felixstowe on 01394 834557 or email us at [email protected].

Kerseys Solicitors are just a click away visit our website and click “Call Me Back” and a member of our Employment Law team will be happy to contact you at a time that is convenient to you.