Lasting Powers of Attorney (“LPAs”)

Lasting Powers of Attorney (“LPAs”)

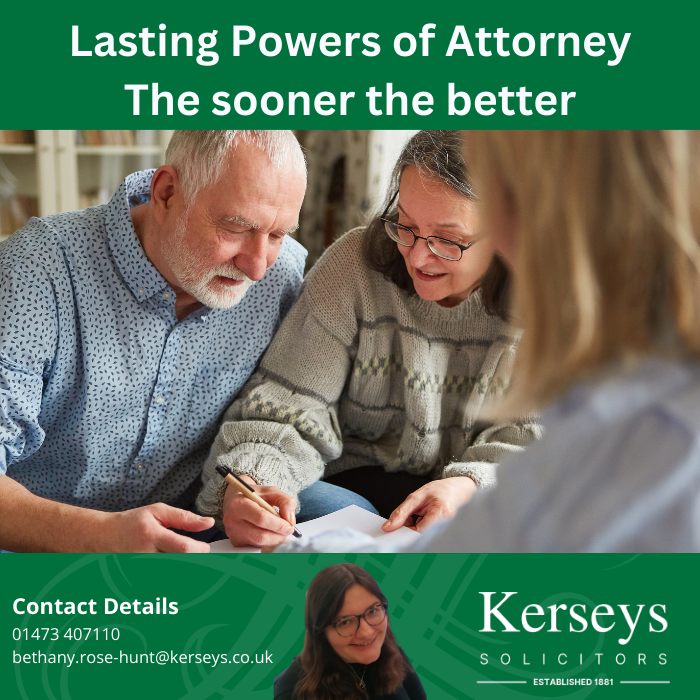

LPAs – The sooner the better

LPAs are becoming ever more important documents as they allow people whilst they have the capacity to appoint trusted chosen persons to make property & financial decisions if the circumstances arise where they no longer have capacity. This can include allowing those trusted persons to make life sustaining treatment decisions on your behalf or allowing them to sell your home should you have to sell your property to pay for care fees. (https://www.gov.uk/power-of-attorney)

The acknowledgment of how invaluable LPAs are has recently been covered by the mainstream media with Martin Lewis discussing LPAs on his ‘Money Show Live’ on 14th March 2023. Mr Lewis notes the importance of LPAs by explaining “if you lose your faculties, if you lose your ability to look after yourself mentally, then the question is what happens to your finances? And the truth is, let’s say it’s dementia or an accident or a stroke – severe ones – don’t assume your family can access your money, not even if it’s the money needed to pay for your care.”

As the awareness of LPAs increases, the Office of the Public Guardian (“OPG”), the body which registers LPAs, has noted that they are registering 18,000 more LPAs every month than before the pandemic. Due to this ‘unprecedented demand’ for LPAs (This Money, 2023), the current wait time for an LPA to be registered with the OPG is 20 weeks. If you hold off on organising your LPAs, you could become caught in a scenario where your LPAs are needed but are still with the OPG for registration due to the 20 weeks wait time. Accordingly, the need for people to organise their LPAs earlier is more crucial than ever.

With Martin Lewis highlighting that the best way to organise LPAs is “to get a solicitor to do it,” due to the nature of the paperwork and signing process, people should not delay organising their LPAs; the sooner the better.

Who can make an LPA?

Anyone who is over the age of 18 and has mental capacity.

What decisions does an LPA cover?

There are 2 types of LPA:

-

a) Property and Financial Affairs LPA – covers decisions about:

- Buying and selling your property

- Running your bank accounts

- Claiming, receiving and using your benefits, pensions and allowances

-

b) Health & Welfare LPA – covers decisions about:

- Staying in your own home

- Moving into residential housing and choosing the most suitable care home for you

- Giving or refusing consent to particular types of health care including medical treatment decisions

Click here to download our brochure. Or telephone to speak with a member of the Private Client team at Kerseys Solicitors in Ipswich on 01473 213311 or Kerseys Solicitors in Colchester on 01206 584584 or email us at [email protected]. We are only a click away, visit our website and click “Call Me Back” and a member of our team will be happy to call you.

Read more: –

https://www.moneysavingexpert.com/news/2023/03/martin-lewis-power-of-attorney/