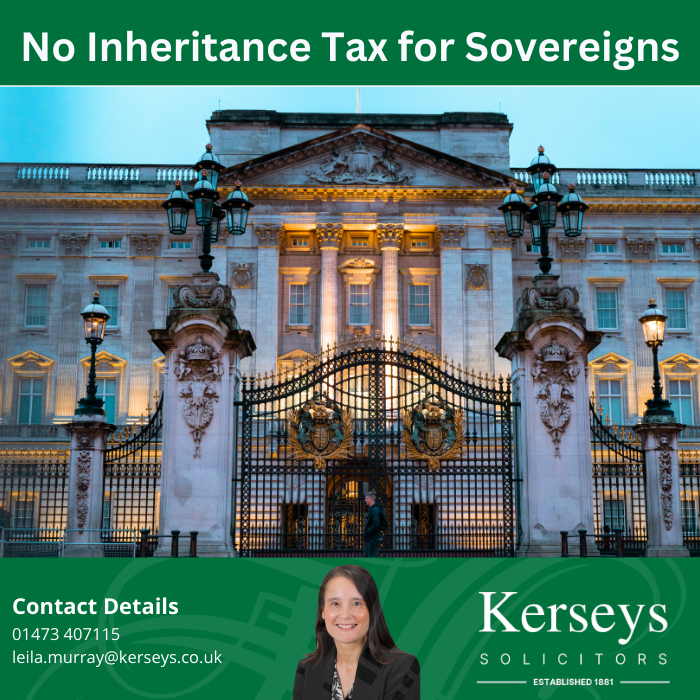

No Inheritance Tax for Sovereigns

No Inheritance Tax for Sovereigns

The general rule is that Inheritance Tax currently at a rate of 40% is charged on the part of a deceased person’s chargeable estate that is above £325,000, subject to certain exemptions.

In 2022, the late Queen Elizabeth II left her entire estate estimated to be worth more than £650 million to her son now King Charles III and due to a 1993 agreement made by the then Prime Minister John Major MP, any inheritance passed from “Sovereign to Sovereign” is now free of Inheritance Tax. The agreement also exempts inheritance passed from the Consort of a former sovereign to a sovereign. This was the case when the late Queen mother died in 2002, when she left her estimated £70 million estate including a Faberge egg collection to her only surviving daughter, Queen Elizabeth II.

The reason for the 1993 decision was to prevent the monarchy’s assets being eroded away through capital taxation over several generations in order to protect the independence of the monarchy.

It should be noted however, that if a monarch wishes to make a cash gift to anybody apart from their direct heir, this would only be exempt from Inheritance Tax if the monarch survives for more than 7 years after making the gift.

If you require further advice on Inheritance Tax, please do not hesitate to contact our Private Client team at Kerseys Solicitors in Ipswich on 01473 213311 or Kerseys Solicitors in Colchester on 01206 584584 or email us at [email protected]. We are only a click away, visit our website and click “Call Me Back” and a member of our Private Client team will be happy to call you.